Weekly overview of raw material market (February 24th – March 1st)

Last week witnessed a general downward trend in the raw material market across various categories. Prices of iron ore continued to plummet; the fourth round of coke price reduction was largely implemented; while the price of coking coal remained relatively stable with slight declines. Meanwhile, prices of various ferroalloys also experienced a downward trend. Here’s a summary of the key price movements:

Significant Decline in Imported Iron Ore Prices Last week, imported iron ore prices witnessed a significant decline. This was mainly attributed to the slow pace of production recovery among domestic steel companies. Facing pressure in the finished product market, some steel mills postponed their production resumption or slowed down their purchasing pace, leading to a noticeable drop in iron ore prices. Currently, the external price of iron ore has declined, with a few steel companies starting to make limited purchases, resulting in a slight increase in external transactions. Meanwhile, spot prices at ports have fallen, further narrowing the gap with iron ore futures prices. With the recovery of steel mill profits and the initiation of downstream demand, steel production is expected to rebound, leading to a recovery in iron ore demand. Although port iron ore inventories have risen, the overall growth rate has slowed down. It is expected that iron ore prices will gradually stabilize in the near term.

Raw materials for the pipeline system

Overall Decline in Domestic Metallurgical Coke Prices The prices of domestic metallurgical coke experienced an overall decline. In detail, prices in the East, North, and Northeast regions decreased by 100 yuan/ton to 110 yuan/ton for coke enterprises; monthly-priced coke enterprises in the Central and South regions decreased by 200 yuan/ton; while the procurement prices of metallurgical coke in fixed-priced steel enterprises in the Southwest region remained stable. With reduced supply of metallurgical coke and increased demand, the blast furnace operating rate of 201 steel companies increased by 0.17 percentage points, while the capacity utilization rate of 200 independent coke enterprises decreased by 1.75 percentage points. The total inventory of the coke industry chain enterprises decreased by 37,000 tons, with a reduction of 101,000 tons in coke inventory for 100 coke enterprises and a decrease of 0.2 days in available coke inventory for 80 steel enterprises. Losses of coke enterprises worsened, with some companies intensifying production limitations and a few suspending operations. Trading enthusiasm among traders has increased, with some coke enterprises adopting a cautious sales strategy. It is predicted that the domestic metallurgical coke market will remain relatively stable in the near term.

Stable to Declining Prices for Coking Coal Last week, prices of coking coal remained stable with slight declines; online auction transaction prices mostly declined with few increases, and some auctions were still unsuccessful. Due to different resumption times and safety inspection impacts, the adjustment of prices varied across coal mines in various regions of Shanxi, the main producing area. In Linfen, Shanxi, the price of low-sulfur coking coal fell by 100 yuan/ton to 2,350 yuan/ton; prices remained stable in Jinzhong, with limited coal production release, and the price of S1.7~1.8 lean coal was between 2,100 yuan/ton and 2,150 yuan/ton; prices of coking coal in Lvliang decreased slightly, with the price of S2.3 coking coal in Liulin at 2,100 yuan/ton, mainly driven by executing previous orders, and the price of S1.0 lean coal fell by 150 yuan/ton to 2,150 yuan/ton. Prices of Huangling and Zichang gas coal in Shaanxi decreased by 50 yuan/ton, marking the first price reduction since the Spring Festival. Some coal mines have not yet adjusted the prices of coking coal or the price adjustments are smaller than those for metallurgical coke, with expectations of supplementary reductions in early March. It is predicted that coking coal prices will remain relatively stable with slight declines in the near term.

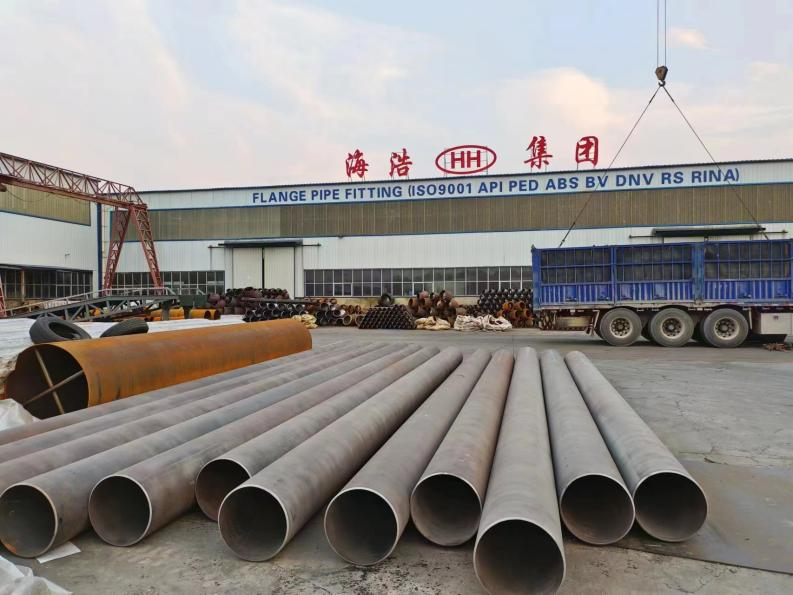

HAIHAO GROUP

Stable to Slightly Declining Prices for Ferroalloys Last week, prices of various ferroalloys remained stable with slight declines. Prices of ferrosilicon remained stable, with minimal overall fluctuations. Prices of ferrosilicon micropowder decreased by 20 yuan/ton to 40 yuan/ton, contributing to the continued decline in production costs of ferrosilicon. Currently, traders are considering a slight increase in ferrosilicon prices. However, the overall bidding prices from steel companies are relatively low, and it is expected that the ferrosilicon market will remain relatively stable in the near term. Prices of silicomanganese slightly decreased, with a market quotation of 6,000 yuan/ton for resources. Spot prices of manganese ore at ports fell by 0.5 yuan/ton, while prices of chemical coke decreased by 80 yuan/ton. The production costs of silicomanganese decreased by approximately 60 yuan/ton. Currently, silicomanganese manufacturers in Ningxia have further intentions to reduce production. However, with high overall market inventory and low bidding prices from steel companies, it is predicted that the silicomanganese market will operate relatively weakly in the near term.

Stable Prices for High Carbon Ferrochrome Prices of high carbon ferrochrome remained stable. Xianggang and Shagang Yongxing Special Steel initiated a new round of high carbon ferrochrome procurement, with prices reduced by 160 yuan/50 basic tons compared to February. The spot price of chromite ore at ports remained stable. Currently, high carbon ferrochrome enterprises in Inner Mongolia are operating on the verge of profit and loss, with low-priced transactions dominating the market. It is expected that high carbon ferrochrome prices will face challenges in the short term, with uncertain fluctuations.

Haihao Group pays attention to changes in raw material market conditions and shares the latest news with customers in a timely manner so that customers can make optimal purchasing strategies. If you need pipeline system products, please continue to follow us and contact us at any time, we will provide you with the best piping system solutions.