Haihao Group’s insight into cold and hot rolled coil price trends

In the midst of the recent dynamics within the steel industry, Haihao Group, as a stalwart in the field of pipeline systems, is attentively observing the fluctuations in prices of cold and hot-rolled coils. Offering a profound understanding of the market, we present our forecast for the future trajectory of cold and hot-rolled coil prices.

Reviewing “Silver October”: During the anticipated “Silver October” period this year, the demand intensity for cold and hot-rolled coils did not exhibit the anticipated strength as expected by steel traders. The market witnessed subdued transactions, resulting in oscillations in the prices of cold and hot-rolled coils, particularly with a noticeable decline in cold-rolled coil prices. Taking Shanghai as an example, the price of 1.0mm cold-rolled coils produced by Angang Steel dropped from ¥5000/ton in early October to ¥4830/ton at the end of October, marking a significant monthly decrease of ¥170/ton. Conversely, the price of 5.5mm hot-rolled coils increased slightly from ¥3810/ton to ¥3830/ton during the same period, registering a marginal monthly rise of ¥20/ton.

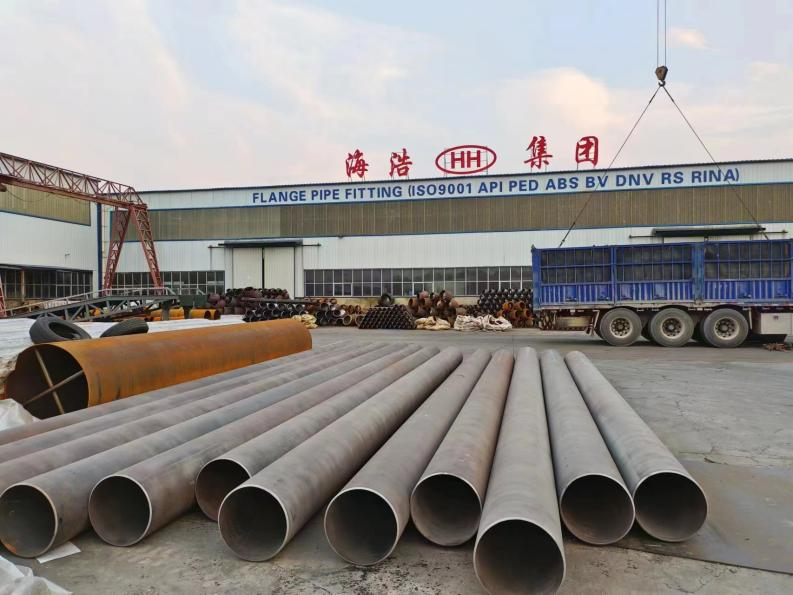

HAIHAO GROUP

November Trends: As we enter November, the prices of cold and hot-rolled coils are exhibiting signs of stabilization after the period of decline. Some varieties are experiencing stability with upward momentum. In the first trading week of November in the Shanghai market, the price of SPHC hot-rolled coils increased by a cumulative ¥20/ton, while Q235B hot-rolled coils rose by a cumulative ¥60/ton. Overall, the supply and inventory of hot-rolled coils are decreasing, and demand remains resilient. For cold-rolled coils in the Shanghai market, prices have cumulatively increased by ¥30/ton.

Short-Term Projections: Looking ahead in the short term, the likelihood of significant fluctuations in the prices of cold and hot-rolled coils is minimal. Several factors contribute to this stability:

Resilient Demand: Industries such as shipbuilding, automotive, construction, machinery, and pressure vessels, which exhibit significant demand for cold and hot-rolled coils, are experiencing positive production, sales, and export conditions. Notably, the shipbuilding industry’s capacity utilization monitoring index (CCI) increased by 22.5% in the first three quarters of this year compared to the same period last year.

Decreased Supply: The reduction in supply due to proactive production cuts by steel enterprises in response to falling steel prices and shrinking profitability has alleviated supply-demand imbalances.

Steady Steel Production Costs: Despite high raw material prices, steel enterprises are maintaining steel production costs at a high level, providing support for the stability of cold and hot-rolled coil prices.

In summary, Haihao Group anticipates that the resilience in demand, reduced supply, and steady steel production costs will contribute to the stabilization of cold and hot-rolled coil prices in the coming months. As experts in the pipeline systems domain, we continue to monitor market dynamics, ensuring that our clients receive accurate insights and exceptional service. Our commitment to quality and foresight positions Haihao Group as a reliable partner in navigating the complex seas of the steel industry.