Insightful analysis on the Iron ore market by Haihao Group

At Haihao Group, we pride ourselves on providing not only top-quality products but also insightful perspectives on the industries we serve. In this spirit, we present our analysis of the current state of the iron ore market, combining both global and domestic factors that shape its dynamics.

Current Market Dynamics: Balancing Act Between Supply and Demand

The iron ore market is currently navigating through a complex interplay of supply and demand forces. On the demand side, the short-term surge in restocking activities has driven port inventories to unprecedented lows, reflecting a robust appetite for iron ore. However, the euphoria surrounding this surge is tempered by the ongoing contraction of profits at steel mills.

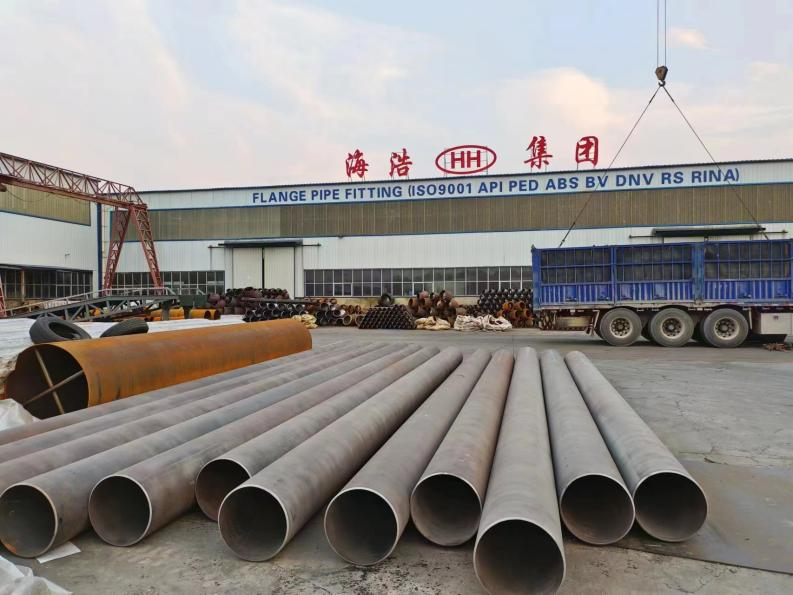

HAIHAO GROUP

Global Economic Landscape: Resilience and Challenges

Internationally, the U.S. economy exhibits resilience, as evidenced by the Federal Reserve’s adjustment of next year’s interest rate expectations. This has contributed to the continued strength of the U.S. dollar, influencing the overall performance of commodity prices, including iron ore. Simultaneously, the rise in the yield of the 10-year U.S. Treasury bonds indicates a potential challenge for the commodities market.

Domestic Economic Factors: Signs of Stabilization

Domestically, economic indicators for August suggest a bottoming out of the overall economic situation. The stabilization of industrial value-added and consumption data plays a pivotal role in supporting economic growth. However, challenges persist in the real estate sector, which, despite some relaxation in non-core area purchase restrictions in Guangzhou, still exhibits signs of weakness.

Large size elbow

Industry-Specific Insights: Challenges and Opportunities

In the mid-term outlook, the real estate sales sector remains persistently weak. Although the relaxation of non-core area purchase restrictions in Guangzhou could have a marginal positive impact, the overall effect is limited. First- and second-tier cities are experiencing a slow recovery in real estate sales data, and property developers are displaying a subdued interest in land acquisition.

Supply and Inventory Dynamics: Seeking Equilibrium

Looking at the supply side, mainstream mines are in a seasonally high shipping cycle. The sustained increase in the Platts iron ore index stimulates the continued high shipping volume of overseas iron ore, maintaining a high level of arrival at ports. Despite this, the likelihood of supply-side contraction remains minimal, given the strong utilization of domestic mine production.

Outlook and Anticipated Trends: Navigating Uncertainties

In the short term, the iron ore market is anticipated to follow the volatility of black commodity futures. Attention should be given to voluntary production cuts by steel mills and the implementation details and effectiveness of administrative production reduction policies in the mid-term.

Conclusion: Haihao Group’s Commitment to Informed Perspectives

Haihao Group remains committed not only to delivering exceptional products but also to providing insightful analyses of the markets we operate in. Our understanding of the complexities of the iron ore market positions us as a reliable partner in times of uncertainty. As we navigate these dynamic market conditions, our dedication to quality and expertise continues to set us apart.

Stay tuned for more industry insights from Haihao Group.